Mapped: Inflation Projections by Country, in 2024

The World’s Top Cocoa Producing Countries

Ranked: Top 10 Single-Day Market Cap Gains

Visualizing Japan’s Top 25 Companies by Market Cap

Who Owns the Most Vehicles per Capita, by Country?

Visualizing Microsoft’s Revenue, by Product Line

What Would $5,000 Invested in Nvidia Be Worth Today?

Mapped: The World’s Top 50 Science and Technology Hubs

Ranked: America’s Best Places to Work in 2024

Charted: Apple’s Product Revenue (2007-2023)

Mapping Credit Card Delinquency Rates in the U.S. by State

The Wealthiest People in the World, Outside of America

The Richest People in the World in 2024

Visualizing Wealth Distribution in America (1990-2023)

Mapped: Countries With a Shrinking Consumer Class by 2030

Charted: Global Tobacco Use by Country and Sex

Visualized: What Lives in Your Gut Microbiome?

Charted: Average Years Left to Live by Age

Charted: The Average Cost of Insulin By Country

Ranked: The Best U.S. States for Retirement

Charted: Global Uranium Reserves, by Country

Visualizing the Rise of the U.S. as Top Crude Oil Producer

2024 U.S. Clean Electricity Outlook

Visualizing All the Nuclear Waste in the World

Cumulative Uranium Production, by Country (1945-2022)

Mapped: Breaking Down the $3 Trillion African Economy by Country

Mapping Credit Card Delinquency Rates in the U.S. by State

Mapped: North America Population Patterns by Density

Mapped: 2024 Global Elections by Country

Mapped: Countries With a Shrinking Consumer Class by 2030

Charted: Global Uranium Reserves, by Country

The Periodic Table of Commodity Returns (2014-2023)

China Dominates the Supply of U.S. Critical Minerals List

The Critical Minerals to China, EU, and U.S. National Security

All the Metals We Mined in One Visualization

The World’s Top Cocoa Producing Countries

Charted: Share of World Forests by Country

2024 U.S. Clean Electricity Outlook

Chart: Is ESG Investing in Decline?

Which Countries Have the Largest Forests?

Published

on

By

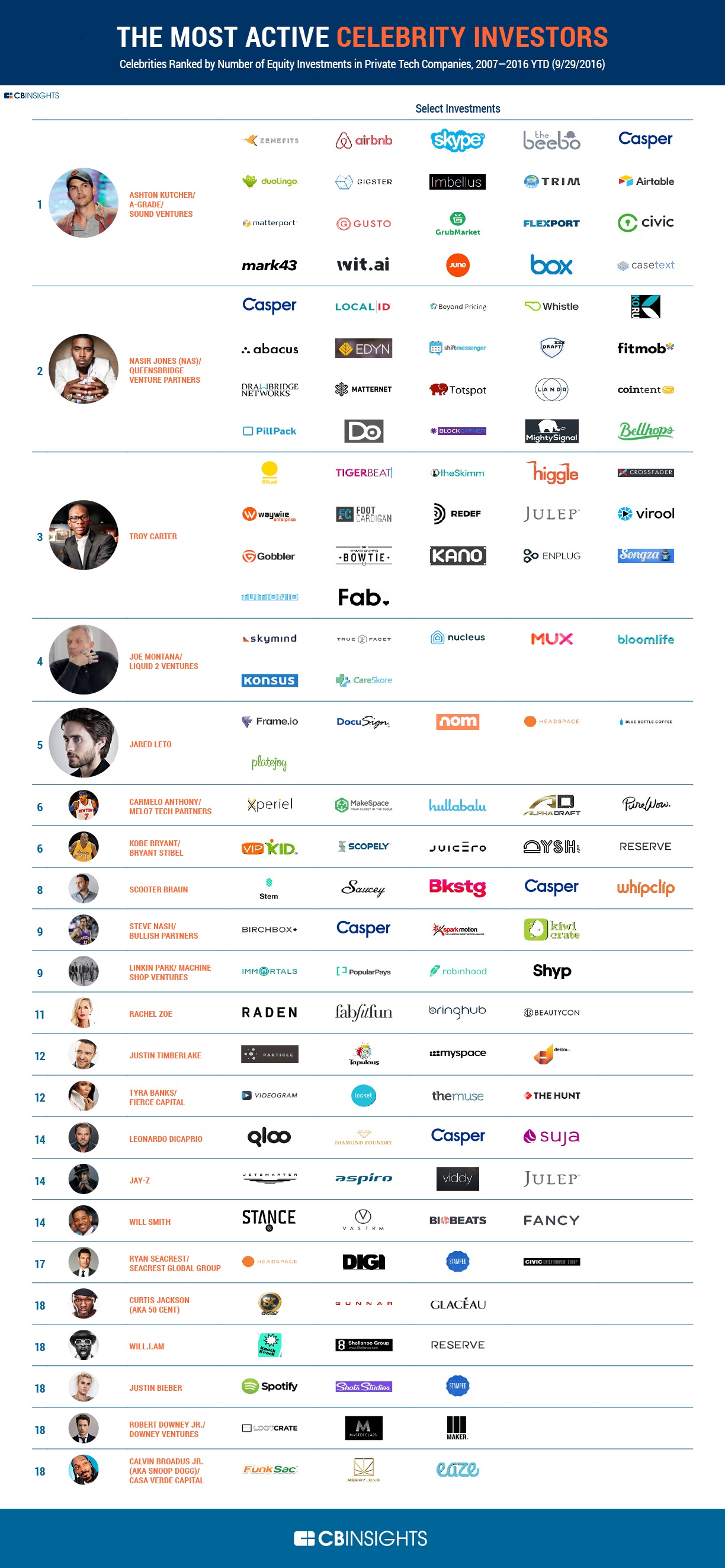

Image courtesy of: CB Insights

Celebrities – they’re just like us! Except that they’re famous, and usually quite wealthy, too. So it’s perhaps not surprising that they would choose to expand their investment portfolios beyond luxury yachts and Hollywood Hills mansions.

Yet, you might be surprised to learn that celebrities have quietly been funding some of today’s fastest-growing startups. Today’s infographic from CB Insights ranks celebrity investors based on the number of private tech companies they’ve invested in over the last decade.

After delving a little deeper into the investment activities of these tech-savvy celebs, we came up with a few key takeaways.

Holding down the top spot on the list is Ashton Kutcher. The former model turned actor, once known for playing lovable stoners on screen (That 70s Show; Dude, Where’s My Car?) has since proven he’s a skilled entrepreneur and investor.

Kutcher co-founded venture fund A-Grade Investments along with Ron Burkle and Guy Oseary in 2010, building a diverse portfolio that includes Spotify, Skype, Airbnb, Foursquare, and Uber, to name a few companies.

According to Forbes, the fund has grown from $30 million to $250 million over the last six years, representing a nearly 8.5x investment multiple, and making the actor somewhat of a legend among Silicon Valley VCs. Kutcher also co-founded A Plus, a viral media site that has reportedly amassed nearly 50 million global monthly unique visitors since its soft launch in 2014, and was acquired by Chicken Soup for the Soul in September 2016.

Coming in at a close second on the list is hip-hop recording artist Nas, AKA Nasir Jones, with a total of 42 investments into 36 companies. Nas co-founded Queensbridge Venture Partners along with manager and business partner Anthony Saleh in 2014. The VC firm has made 128 investments into 118 companies spanning media, health care, retail, Bitcoin, and cyber security, with a portfolio that includes heavyweights such as Lyft and Dropbox.

Casper, the NYC-based online manufacturer of foldable memory foam beds, appears on this list a total of five times, having received funding from Ashton Kutcher, Nas, Scooter Braun, Steve Nash, and Leonardo DiCaprio. The startup famously generated $1 million in sales within its first 28 days of business.

The company is backed by other celebrities off the above list as well, showing that Casper has tapped into somewhat of a celebrity network effect. Tobey Maguire and Adam Levine joined the party, putting money into the Series B round for $55 million.

Casper recently surpassed $100 million in cumulative sales, has launched a line of sheets and pillows, and forayed into dog beds. The company, which is planning to expand internationally, has reportedly raised a total of $72 million, with a total valuation of $550 million.

Calvin Broadus Jr, the pot-loving multi-platinum hip-hop recording artist also known as Snoop Dogg, founded Casa Verde Capital in 2015. The marijuana-centric investment firm’s repertoire of weed-based ventures includes Merry Jane, an online media channel dedicated to cannabis culture; Funksac, a manufacturer of recyclable packaging for medical and recreational marijuana; and Eaze, an online medical marijuana delivery service.

Recently he partnered with Canadian medical marijuana producer Tweed, and launched his own cannabis line called Leafs by Snoop. However, the rapper is clearly diversifying his portfolio; he’s also invested in online media company Reddit along with Jared Leto, and zero-commission stock trading app Robinhood along with Leto and Nas.

There’s Big Money to Be Made in Asteroid Mining

The Industrial Internet of Things (IIoT): Are Companies Ready For It?

Charted: Apple’s Product Revenue (2007-2023)

Ranked: The Most Popular AI Tools

Charted: Chinese FDI Inflows Hit Multi-Year Lows

Charted: S&P 500 Sector Performance in 2023

Ranked: Which Asset Class Logged the Biggest Return in 2023?

Mapping the Biggest Tech Talent Hubs in the U.S. and Canada

There are roughly 1,400 unicorns—startups worth $1 billion or more. How many years does it take these giants to get acquired or go public?

Published

on

By

For most unicorns—startups with a $1 billion valuation or more—it can take years to see a liquidity event.

Take Twitter, which went public seven years after its 2006 founding. Or Uber, which had an IPO after a decade of operation in 2019. After all, companies first have to succeed and build up their valuation in order to not go bankrupt or dissolve. Few are able to succeed and capitalize in a quick and tidy manner.

So when do unicorns exit, either successfully through an IPO or acquisition, or unsuccessfully through bankruptcy or liquidation? The above visualization from Ilya Strebulaev breaks down the time it took for 595 unicorns to exit from 1997 to 2022.

Here’s how unicorn exits broke down over the last 25 years. Data was collected by Strebulaev at the Venture Capital Initiative in Stanford and covers exits up to October 2022:

Overall, unicorns exited after a median of eight years in business.

Companies like Facebook, LinkedIn, and Indeed are among the unicorns that exited in exactly eight years, which in total made up 10% of tracked exits. Another major example is Zoom, which launched in 2011 and went public in 2019 at a $9.2 billion valuation.

There were also many earlier exits, such as YouTube’s one-year turnaround from 2005 founding to 2006 acquisition by Google. Groupon also had an early exit just three years after its founding in 2008, after turning down an even earlier acquisition exit (also through Google).

In total, unicorn exits within 11 years or less accounted for just over three-quarters of tracked exits from 1997 to 2022. Many of the companies that took longer to exit also took longer to reach unicorn status, including website company Squarespace, which was founded in 2003 but didn’t reach a billion-dollar valuation until 2017 (and listed on the NYSE in 2021).

Broadly speaking, there are three main types of exits: going public through an IPO, SPAC, or direct listing, being acquired, or liquidation/bankruptcy.

The most well-known are IPOs, or initial public offerings. These are the most common types of unicorn exits in strong market conditions, with 2021 seeing 79 unicorn IPOs globally, with $83 billion in proceeds.

But the number of IPOs drops drastically given weaker market performance, as seen above. At the end of 2022, an estimated 91% of unicorn IPOs listed since 2021 had share prices fall below their IPO price.

A less common unicorn exit is an SPAC (special purpose acquisition company), although they’ve been gaining momentum and were used by WeWork and BuzzFeed. With an SPAC, a shell company raises money in an IPO and merges with a private company to take it public.

Finally, while an IPO lists new shares to the public with an underwriter, a direct listing sells existing shares without an underwriter. Though it was historically seen as a cheaper IPO alternative, some well-known unicorns have used direct listings including Roblox and Coinbase.

And as valuations for unicorns (and their public listings) have grown, acquisitions have become less frequent. Additionally, many major firms have been buying back shares since 2022 to shore up investor confidence instead of engaging in acquisitions.

While the growth of unicorns has been exponential over the last decade, exit activity has virtually ground to a halt in 2023.

Investor caution and increased conservation of capital have contributed to the lack of unicorn exits. As of the second quarter of 2023, just eight unicorns in the U.S. exited. These include Mosaic ML, an artificial intelligence startup, and carbon recycling firm LanzaTech.

As exit activity declines, companies may halt listing plans and eventually slow expansion and cut costs. What’s uncertain is whether or not this lull in unicorn exits—and declining influx of private capital influx—is temporary or part of a long-term readjustment.

The World’s Top Cocoa Producing Countries

Who Owns the Most Vehicles per Capita, by Country?

The Richest People in the World in 2024

Visualizing Japan’s Top 25 Companies by Market Cap

What Would $5,000 Invested in Nvidia Be Worth Today?

Breaking Down $1.3T in NATO Defense Spending

Ranked: Top 10 Single-Day Market Cap Gains

The Best Visualizations of February on the Voronoi App

Copyright © 2024 Visual Capitalist